After you have successfully registered your business name online, you will need to also get a Tax Identification Number, TIN for your business name to enable you pay tax and avoid harassments by Tax officials. A business may also be denied contracts in some places if such do not have any proof of tax payments, in order to avoid becoming a victim, you should follow the steps in this post to help you in generating TIN for your business name online.

TIN stands for Tax Identification Number. It is a unique number that identifies an individual or business for tax payments. Since it is compulsory to pay tax, it is therefore mandatory to get TIN for your business name in Nigeria so as to enable you pay the appropriate tax for your business. I have written this post to enable you apply and get your Tax Identification Number online with ease.

How to Get Tax Identification Number for your Business in Nigeria Online

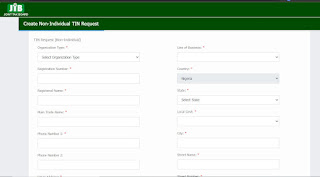

- Visit https://tin.jtb.gov.ng/TinRequestExternal

- Select the appropriate organization type (in this case "business name")

- Enter the Business Registration Number you were given after successfully registering your business name e.g BN1919098

- After step 3 above, some of the empty fields will be automatically populated for you such as your registered name and your main trade name

- Make sure you fill all the fields marked with *red asterisk then click "submit"

- Pay close attention to the email address you entered in the form for further details on the status of your TIN application

Benefits of getting Tax Identification Number (TIN) for your Business Name

- It is required for opening a cooperate bank account for your business (see section 28(1) of the Personal Income Tax act, amended by the Finance act 2020 - click here to check it out).

- It enables you to qualify for Government loans.

- It enables you to apply for professional licenses such as trade, import and export licenses

Comments

Post a Comment

Important - If you ask a question make sure you tick the "Notify Me" box below the comment form to be notified of follow up comments and replies.